Version française / Manifestations scientifiques / journées d'études, tables rondes

- Recherche - EOS,

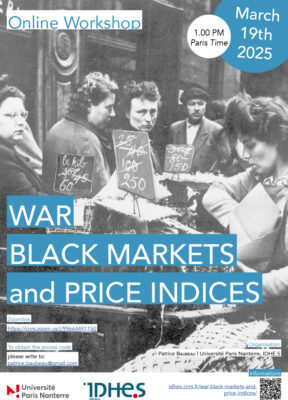

War, Black Markets and Price indices

Workshop organisé par l'IDHE.S

le 19 mars 2025

Online exclusively

Zoomlink:

https://cnrs.zoom.us/j/99664491150

To obtain the access code, please write to patrice.baubeau@gmail.com

Organisation

Patrice Baubeau, université Paris Nanterre, IDHE.S

Program (provisional)

Patrice Baubeau | Univ. Paris Nanterre

“Introduction. The black market paradox: present, future and past of price indices”

Patrice Baubeau | Univ. Paris Nanterre and Matéo Teixeira | Univ. Lyon 2

“Converging evidence: assessing the value of alternative price indices estimates”

Jonas Ljunberg | Lund University

“European consumer price indices since 1870”

Sophia Lazaretou | Bank of Greece

“An overview of inflation and price indices in Greece: metrics, definitions and data series. The long record”

Masato Shizume | Waseda University

“Black Market Prices during World War II in Japan: An Estimate Using the Hedonic Approach”

Vicent Carret | Creighton University

[Provisional title] “What stopped the Korean War inflation? A closer look at the price index”

Argument

Inflation has recently made a remarkable come-back (Visco 2023) – not that it ever had completely disappeared, but it seemed, until recently, the preserve of bad public policies, such as grossly unbalanced government budgets (Argentina), misguided monetary policy (Turkey), intense civil strife (Venezuela) or almost complete state failure (Zimbabwe). Save these cases, the magic formula to keep prices stable – that is perfectly inflationary but at a stable level generally set at 2% per annum – seemed to have been found, both in terms of public finance and monetary policy.

The reason why the 2022-2023 inflationary peak has been so disturbing is not inflation only, but also its social and political consequences, as demonstrated by the wave of anger that has toppled governments and heads of states in many OECD countries in its wake (USA, France, United Kingdom and even Germany among others).

In macroeconomic terms, this may seem strange, as wage gains, in gross terms, have generally followed closely on prices hikes or even outpaced them as of Dec. 2024. If so, why would inflation prove to be so socially and politically disruptive?

One common narrative has been a new version of the “money veil” theory, according to which people are victims of cognitive biases (1) to adapt to changing prices – a little knowledge of the French Revolution era would have dispelled such patronizing ideas. In short, people would have been angered by the rise in prices, not realizing their wages were catching up…

But is it not possible that what a macroeconomist calls “inflation” is only part of the story, i.e. an abstract figure that does not account for the actual experience of an individual (Binetti, Nuzzi, and Stantcheva 2024)? Since price indices were first introduced, at the end of the 19th century, this question has been lingering, with consequences on what is measured, weighted and how (Ljungberg 2025). Statisticians remind us that the inflation figure is precisely that: a figure meant to capture all consumer expenses prices movements, in adequate proportion to the eoective expenses, and thus putting more emphasis on the experience of those who spend the most… (Easterly and Fischer 2001)

If so, one has to be very careful when studying “the” inflation. What if inflation came in many forms, even simultaneously? To explore this question, and the related questions of measure, prices movements, real wages, good policies, we propose to focus on extreme situations (Rockoo 1981). These historical events, because they are related to wars, combine inflation, of course, i.e. consumer price increases, but also monetary disorder, public budgets imbalance, military looting and occupation, physical destruction, and shortages to the point, sometimes, of deprivation and famine.

Needless to say, history may here provide us with hindsight in regard of the dramatic events that have unfolded since 2022, first in Ukraine, then in Gaza, with repercussions most notably in Russia and Iran.

In such contexts, what do prices mean? How prices, quantities, qualities, varieties are arbitraged and determined? Is a black market really a market? How do behave prices elasticities? Does monetary policy make a dioerence? What are the conditions of an eoicient rationing? What is the purpose and the eoiciency of price control? Is repression the only or the best way? How is hyperinflation, the scourge of fragile countries, avoided?

Is it even possible to compute and use a “price index”? Or several? How to assess “real wages” and consumer “spending” when part or most of it is illegal?

From a more general perspective, how are these “black prices” incorporated in prices indices? And what do these indices measure: the evolution of the cost of living, general or comprehensive price movements, the purchasing power of money? The varying quality of price indices before, during and after war and inflationary episodes add an extra layer of complexity to these issues.

Through extreme situations, we intend to shed light on the price-market-crisis nexus, to better understand how a price index is suited to a situation (and not another) or even implicitly related to a set of policies or political economy choices. We also aim at developing tools to better assess prices movements in times of crisis, their social impact and the ways they were either tamed or evolved into hyperinflation. Questions and methods, not only results, will thus be at the heart of the workshop.

If you are interested in participating in the workshop, please send a (tentative) paper on a war/inflation episode which raises issues in terms of assessment and historical record to patrice.baubeau@gmail.com.

(1) Jean-Luc Tavernier, Insee’s General manager (Insee is the French public statistical body responsible for computing price indices) has declared on the public broadcast France Inter, 23 Dec. 2024: “Something I repeat regularly, and I don’t think everyone is fully aware of it, is that overall in 2024 there will have been an increase in purchasing power, in household income, for the French as a whole. […] We have cognitive biases, we know that prices have risen, we remember the prices of four years ago, we can see that prices have risen. What we don’t realise is that at the same time wages, benefits and pensions, for example, have also risen sharply and that overall we haven’t lost any purchasing power.” [Translated with DeepL.com (free version)] Original quotation: “Quelque chose que je répète régulièrement et tout le monde n’en a pas je pense parfaitement conscience, c’est que globalement sur l’année 2024 il y aura eu une hausse du pouvoir d’achat, du revenu des ménages, de l’ensemble des Français. […] On a des biais cognitifs, on sait bien que les prix ont augmenté, on se rappelle les prix d’il y a quatre ans, on le vit que les prix ont augmenté. On vit moins que parallèlement les salaires, les prestations, les retraites par exemple ont aussi fortement augmenté et que globalement on n’a pas perdu de pouvoir d’achat.”,

https://www.dailymotion.com/video/x9b8key, ca 13 mn after start, retrieved Dec. 23rd 2024.

References

Binetti, Alberto, Francesco Nuzzi, and Stefanie Stantcheva. 2024. ‘People’s Understanding of Inflation’. Journal of Monetary Economics 103652. doi: 10.1016/j.jmoneco.2024.103652.

Easterly, William, and Stanley Fischer. 2001. ‘Inflation and the Poor’. Journal of Money, Credit and Banking 33(2):160–78. doi: 10.2307/2673879.

Ljungberg, Jonas. 2025. ‘European Consumer Price Indices since 1870’. Cliometrica 19(1):29–80. doi: 10.1007/s11698-024-00283-6.

Rockoo, Hugh. 1981. ‘Price and Wage Controls in Four Wartime Periods’. The Journal of Economic History 41(2):381–401. doi: 10.1017/S002205070004362X.

Visco, Ignazio. 2023. ‘Monetary Policy and the Return of Inflation: Questions, Charts and Tentative Answers’. (122).

Mis à jour le 21 février 2025